Health Insurance plans are available in various varieties; some examples of this would be HMO and PPO plans. When choosing a health insurance plan, there are a few things to consider, keep reading to learn more.

Private health insurance plans partner with networks of health care systems and providers. These plans work differently with these networks, so it is imperative to understand the differences within these plans.

HMO: Health Maintenance Organization

HMO plans do not cover any out-of-network health care costs. These plans are very limiting when it comes to gaining access to your network of providers. With an HMO plan, you will need to select a Primary Care Physician (PCP) that is within your network. All of your health care necessities are coordinated through your PCP, and to be seen by a specialist, you’ll need a referral from your PCP.

PPO: Preferred Provider Organization

PPO plans have out-of-network benefits and are less limiting when gaining access to your network of providers. You have the choice of seeing an in-network provider at a lower cost or an out-of-network provider at a higher cost. PPO plans do not require you to choose a PCP to be referred to a specialist. However, in some states, you’ll need to be established with a PCP in order to see a specialist.

EPO: Exclusive Provider Organization

EPO plans are a hybrid of HMO and PPO. EPO plans give you the ability to see a specialist without a referral but do not have out-of-network benefits.

POS: Point of Service

POS plans are another combination of HMO and PPO plans. With an EPO plan, you’ll have a Primacy Care Provider on an HMO network that will coordinate your care. You’ll also have access to PPO out-of-network benefits at a higher cost. You will still need a referral from your PCP to see an HMO specialist as part of the in-network benefits.

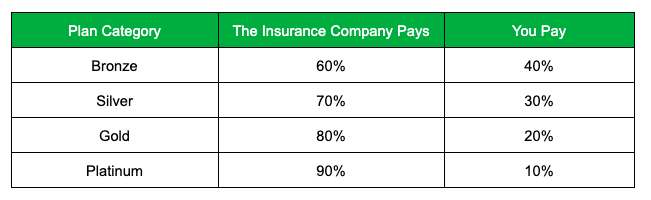

Metal Tiers

Health insurance is there to split medical costs between the insurer and the insured. There are four metal categories your health insurance plan could fall under. The metal tiers show you how you and your plan will be splitting the costs of medical care, not the quality of care.

Everything You Need to Know About Teladoc

Everything You Need to Know About Teladoc

How Important is Dental Insurance?

How Important is Dental Insurance?

Pre-existing Conditions and Short-Term Medical

Pre-existing Conditions and Short-Term Medical

5 Easy Exercises You Can Do at Home!

5 Easy Exercises You Can Do at Home!